What Will Pop This Equity Bubble?

Trying to find the pin prick that will pop this bubble

As a soap bubble drifts higher, the water film holding it together gradually evaporates until it finally bursts. Equity market bubbles are a little different -they often keep floating long after gravity should have taken hold, buoyed by leverage, liquidity, and collective belief.

But every bubble, no matter how high it rises, is pricked by a pin in the end. And this one, as we discussed a few weeks ago, is already among the largest equity bubbles in history - bigger in valuation, concentration, and investor conviction than anything we’ve seen in decades.

So what could end this bubble?

What Can Pop a Bubble?

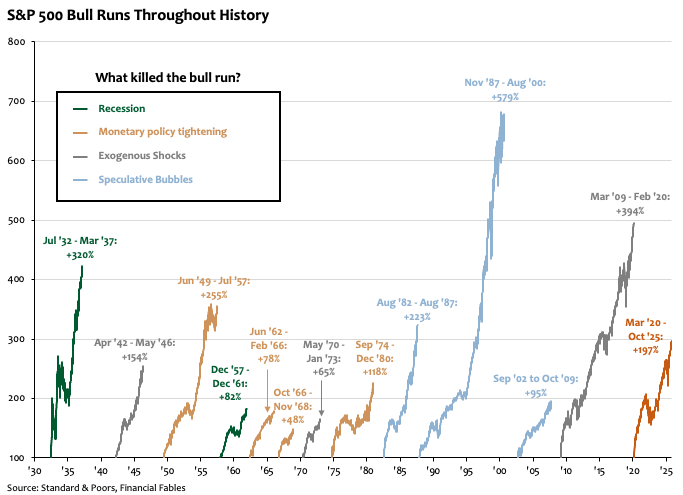

About a year ago, I wrote a piece entitled Murder Mystery: Who Kills Equity Bull Runs? The gist was simple: for much of the 20th century, equity bull runs didn’t just fade with age - they were murdered, usually by either the Federal Reserve’s (Fed) rate hikes or an approaching recession.

The chart below shows that of the eight bull runs between the 1930s and early 1980s, aggressive tightening by the Fed or a recession ended six.

Looking at that trend, many investors would have expected the aggressive monetary tightening of 2021–22 to do the same this time. The Fed hiked rates by 525 basis points - its most aggressive tightening cycle in half a century - and although the S&P 500 briefly corrected by 25%, it soon adjusted to the higher-rate world and marched higher again.

So why haven’t rate hikes or slower growth managed to pop this bubble? Since the 1980s, financial markets have drifted away from the real economy. Public and private equities now equal roughly 300% of U.S GDP, up from just 50% four decades ago. As markets have grown larger than the economies they represent, classic killers like recessions or Fed policy have lost their sting. To understand how bubbles burst today, we have to look at more recent history.

Modern Bull Run’s Self-implode

As markets have become increasingly detached from fundamentals, external shocks like slower growth or tighter policy no longer deliver the knockout blow. Since the 1980s, most collapses have come from within as from speculative mania turn in on themselves. Think Black Monday in 1987, the dot-com crash of 2000, or the housing implosion of 2008.

Spending too much time watching economic data misses the point. Modern bubbles tend to self-destruct through internal weakness, not external pressure. Investors would do better to watch the companies at the heart of the story - their earnings, their accounting, and their operating performance - for early signs of strain.

Where Will the Pin Prick Come From?

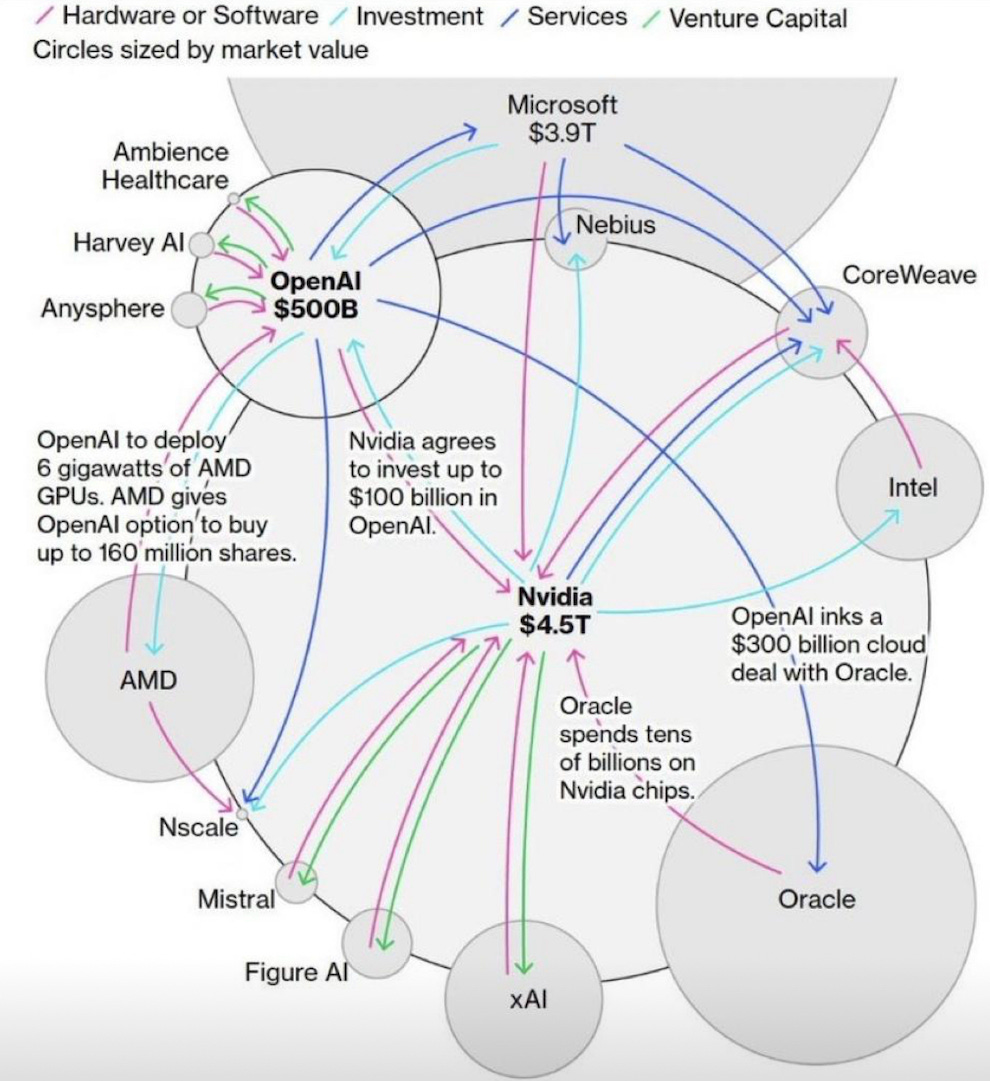

The diagram below is Bloomberg’s now-viral map of the “AI bubble.” It captures the strange reflexivity of today’s market: a handful of companies - OpenAI, Nvidia, Microsoft, Oracle - locked in a self-reinforcing loop of investment, service contracts, and hardware dependence. Nvidia invests in OpenAI; OpenAI buys Nvidia chips; Microsoft sells cloud capacity to OpenAI; Oracle finances and hosts them both. At first glance, it all looks a bit precarious, like a house of cards where each player props up the others.

But the diagram has a flaw. It leaves out the real economy beneath it: the datacentres, chip foundries, energy demand, and the still-limited adoption of AI tools by paying customers. The chart gets the mood right but the mechanics wrong. What it shows is capital circulating inside a closed system, not flowing outward into genuine productivity gains.

With that being said, what the diagram does capture well is the core of the AI ecosystem and the handful of companies that truly anchor it. These are the firms whose balance sheets, supply chains, and valuations form the foundations of the current market narrative. In all likelihood, the pin that bursts this bubble won’t come from the periphery but from within - through earnings weakness, accounting irregularities, or operating missteps at one of the following giants: Nvidia, Intel, Oracle, AMD, or Microsoft. In an odd way, the earnings releases of these five corporations may now be more important than any macro indicator, because the fate of the “AI economy” rests on just a handful of earnings calls.

Disclaimer: The information provided in this blog post is for general informational purposes only and should not be construed as financial, investment, or professional advice. The content is not intended as a solicitation, recommendation, endorsement, or offer to buy or sell any securities or financial instruments. Any reliance you place on such information is strictly at your own risk. Always consult with a qualified financial advisor or professional before making any investment decisions. The author and the website assume no responsibility for any losses or damages that may result from the use of or reliance upon the information provided in this blog post.