Are We in an Asset Bubble… Again?

And why it could keep getting bigger

As a long-suffering West Ham fan, popping bubbles is something I know all too well. For those unfamiliar with the football (soccer) club, every home game begins with a hearty yet haunting rendition of “I’m Forever Blowing Bubbles” - which ends with the line, “and just like my dreams, they fade and die.”

In financial markets, however, the bubbles investment strategists point to these days don’t seem to be fading or dying. Over my summer break, I found that almost every conversation whether with colleagues, friends, or fellow travellers somehow circled back to the same question: are we in an asset bubble?

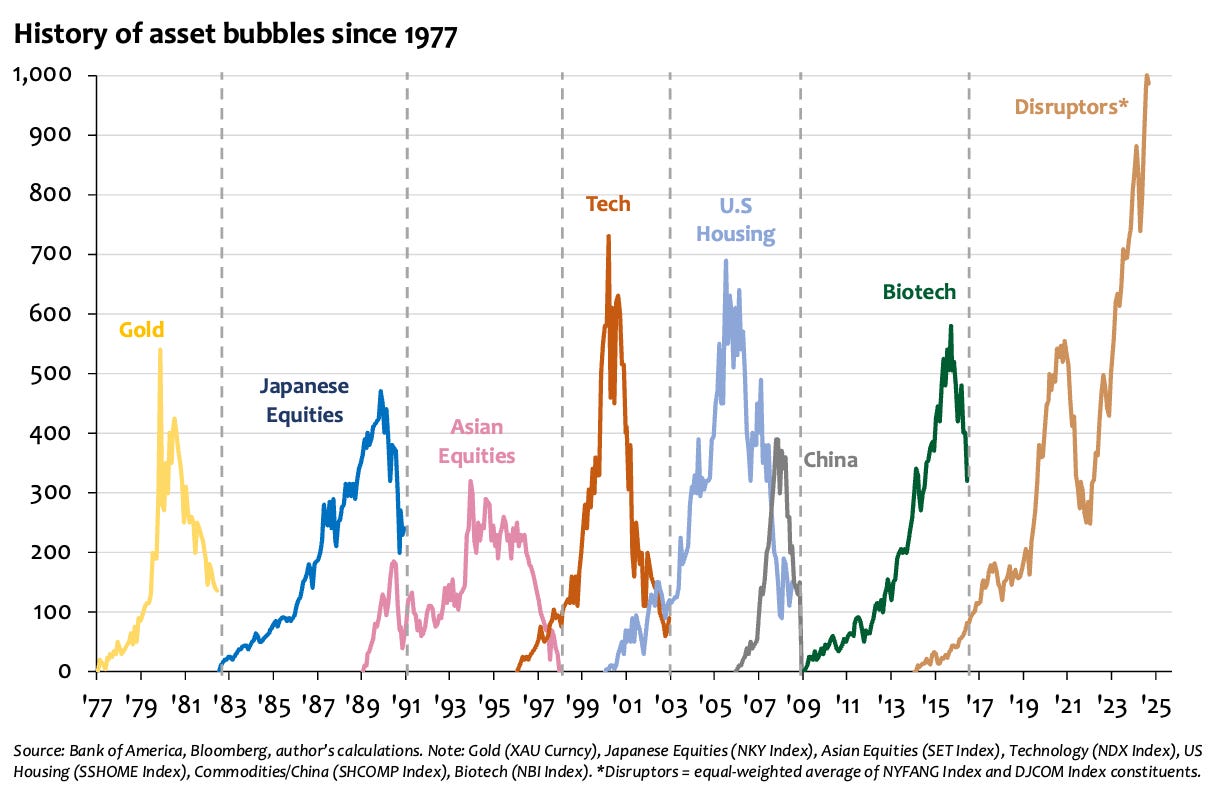

As the chart below shows, the latest disruptor bubble, fuelled by the surge of mega-cap tech and innovation stocks, has already swelled far beyond the peaks of past market frenzies. Which begs the question: why has this bubble grown so much larger, and what might eventually cause it to pop?

Why does this bubble keep growing?

There isn’t a single, simple explanation that explains why this equity bubble has been able to inflate to such a gigantic size relative to prior

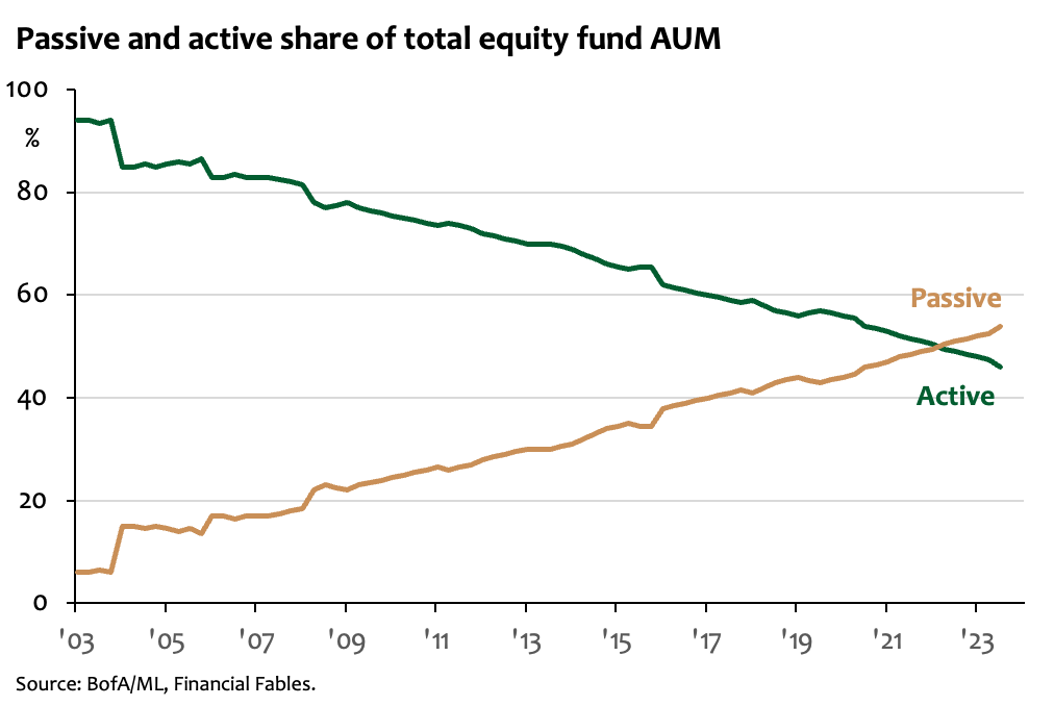

The dominance of passive investing: Passive strategies now account for the lion’s share of equity assets, which has only accelerated and amplified the scale of this bubble. By definition, passive investing follows the benchmark without question. If Amazon makes up 4% of the S&P 500 index, then 4% of every passive dollar must go into Amazon regardless of valuation. This mechanical flow strips away price discovery, concentrates flows into the same mega-cap names, and magnifies herding behaviour. This structural feature means equity bubbles can inflate to far larger levels than their historical counterparts.

The disappearance of patient capital: Deflating a bubble requires time and resilience - two things today’s financial system has little tolerance for. Contrarian managers and hedge funds are rarely given the luxury of years to sit on losing positions. Investors, hypersensitive to fees and quarterly performance, are quick to redeem if they don’t see immediate payoffs. Betting against a bubble almost guarantees short-term pain, but few are willing to endure it. This obsession with instant returns makes it nearly impossible for managers to build the kind of long-term contrarian positions that once kept excesses in check.

The absence of credible alternatives: Even investors who recognize U.S. equities are overpriced face a dilemma: where else to go? For many portfolios, U.S. stocks represent 30–60% of total exposure but the viable substitutes are hardly compelling. Government bonds look like a fiscal crisis in waiting. European equities continue to look like a value-trap. China is mired in twin challenges of debt and demographics. Other asset classes, like EM equities or private assets, either lack sufficient scale or carry too many structural risks. With so few options, investors are effectively trapped, forced to buy into the MAG-7 bubble even as valuations grow to dizzying levels.

Watching and Waiting for Bubbles to Pop

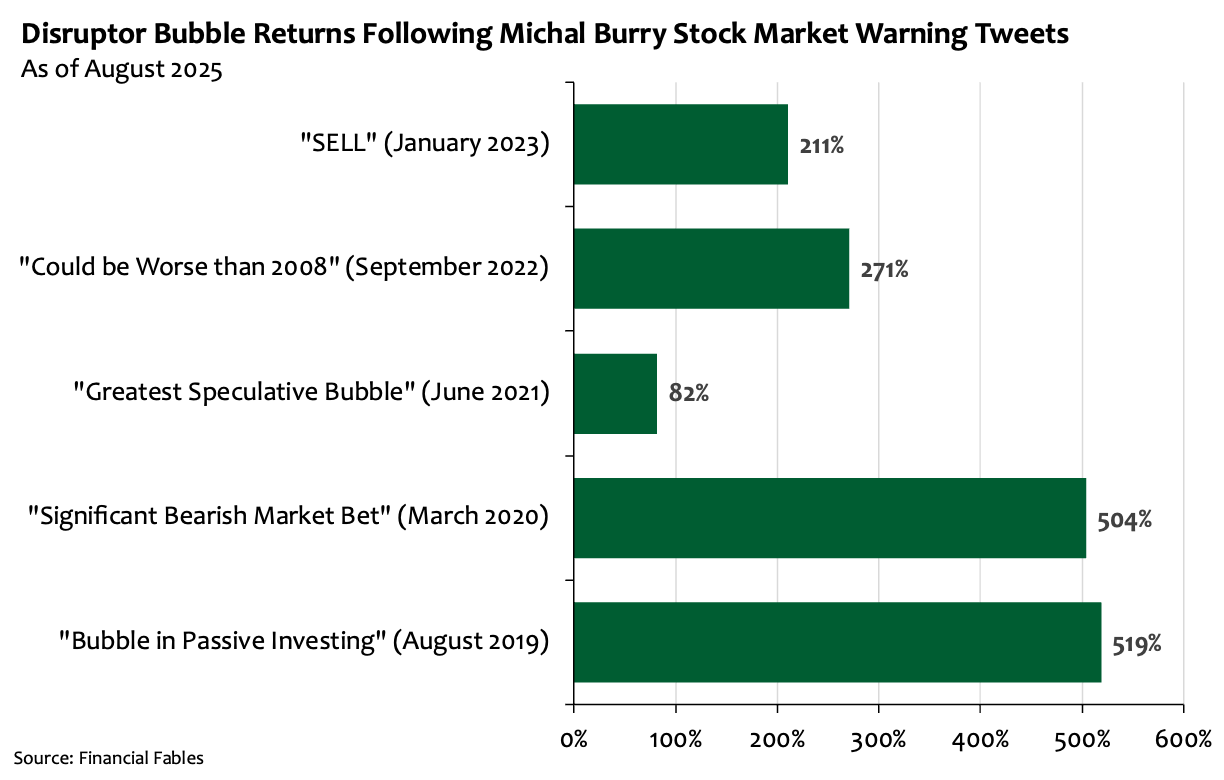

Economists and investment strategists often enjoy the luxury of making bold predictions without ever being held to account when they’re wrong. Michael Burry, who famously spotted the housing bubble in the build up to the Global Financial Crisis, offers a case in point. Since 2019 he has repeatedly warned of bubbles and impending crashes, from a “bubble in passive investing” to claims markets could be “worse than 2008.” Yet, as the chart below shows, the so-called disruptor bubble has only surged higher after each bearish call, in some cases by more than 500%. For investors, this is a reminder that dire warnings may sound compelling, but acting on them too early can be just as costly as ignoring them altogether.

This raises an uncomfortable possibility - what looks like a bubble may instead reflect a structural shift in how modern capital markets function. The dominance of passive flows, hyper-sensitivity to fees, and the lack of credible alternatives mean today’s valuations may not be a passing distortion but the new baseline. Even the Fed’s attempt to prick the bubble with the highest interest rates in decades hasn’t done much to deflate it. That suggests this expansion could last far longer than the doomsayers expect.

So investors, like long-suffering West Ham fans, just have to sit tight and sing along. The bubbles will burst eventually however, if being a West Ham supporter has taught me anything, it’s usually right after you’ve really got your hopes up.

Disclaimer: The information provided in this blog post is for general informational purposes only and should not be construed as financial, investment, or professional advice. The content is not intended as a solicitation, recommendation, endorsement, or offer to buy or sell any securities or financial instruments. Any reliance you place on such information is strictly at your own risk. Always consult with a qualified financial advisor or professional before making any investment decisions. The author and the website assume no responsibility for any losses or damages that may result from the use of or reliance upon the information provided in this blog post.