We often use the phrase powder keg to describe geopolitical risk in financial markets. Small sparks can lead to sudden, outsized consequences. Think of the Gunpowder Plot of 1605 - famously foiled before it could blow up the English Parliament. But in today’s world, fuses aren’t always caught in time and when they ignite, the explosions often hit financial markets first.

To borrow and slightly update Bismarck’s old line: “If there is ever another World War, it will come out of some damned foolish thing in the Middle East.”

It’s a line worth keeping in mind. The region remains one of the most strategically sensitive on the planet and a place where rising tensions can still have outsized effects on global markets, especially energy.

Why are oil prices so sensitive to geopolitical risk?

Global oil prices jumped more than 6%, their largest single-day increase in over five years, in response to rising tensions in the region.

Whenever events like this happen, I’m reminded of the map below. Long-time followers of J.P. Morgan’s Guide to the Markets may recognise a version of it. I’ve always found it a useful visual to explain why geopolitical tensions in the Middle East so quickly feed through to global oil prices.

This relatively small cluster of countries accounts for over a third of global petroleum production — a reminder that despite the push toward green energy, oil still powers much of the world economy. Even more importantly, much of this oil flows through a handful of narrow, vulnerable chokepoints. The Strait of Hormuz alone sees 20% of global oil transit through its waters. The Suez Canal and Bab el-Mandab are similarly critical arteries.

In this environment, even a small conflict or local disruption can send oil prices soaring. The presence of numerous foreign military bases further heightens the risk that a minor incident could spiral into a broader confrontation.

In short, the Middle East remains a geopolitical powder keg - and a key transmission point for risk into global energy markets.

How to hedge geopolitical risk?

It’s all well and good discussing the mounting geopolitical risks but how can investors actually prepare for it? As we’ve seen, the global financial system is a powder keg in its own right, with geopolitical sparks capable of igniting market volatility across assets. So what tools do investors have at their disposal?

Gold protection

Most investors do not hold gold directly; instead, they own it indirectly through ETFs, futures, or unallocated accounts. In reality, the ratio of ‘paper gold’ to ‘physical gold’ is, by some estimates, as high as 133:1. Most of the time, the distinction between paper and physical gold doesn’t particularly matter. However, when hedging geopolitical risk, we need to be mindful of the tipping point.

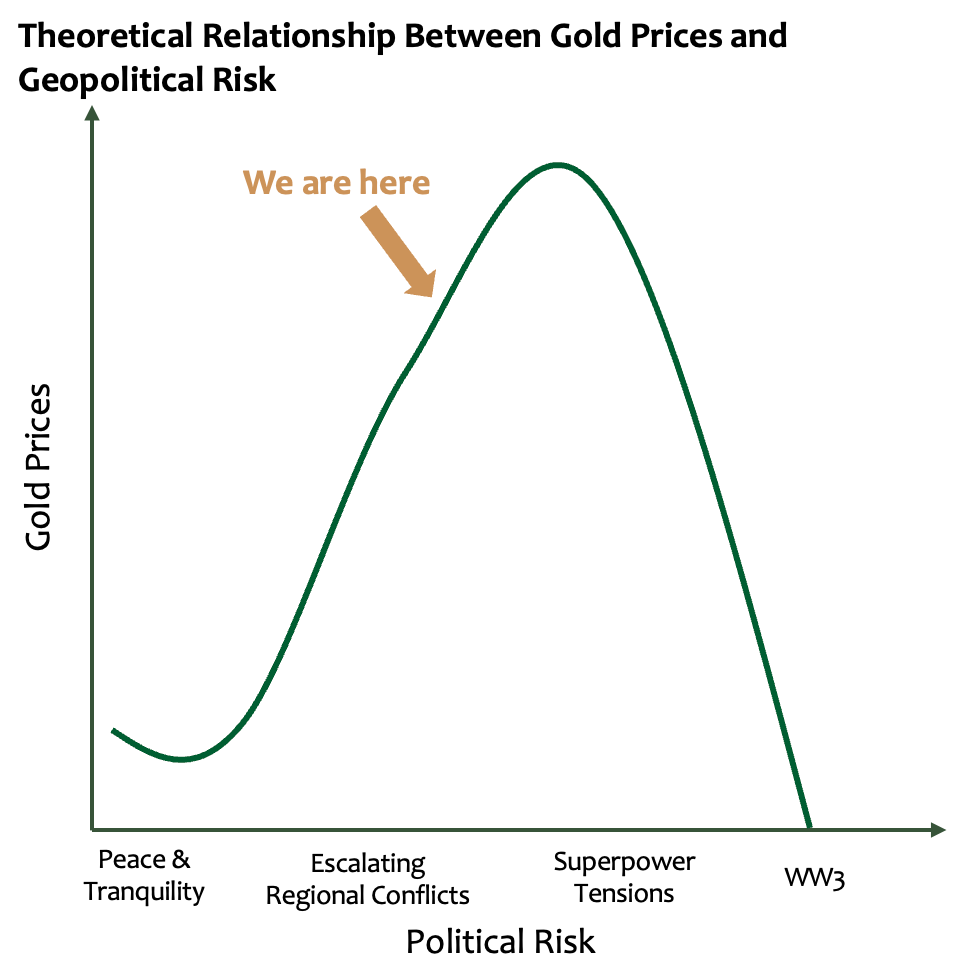

As my primitive diagram below suggests, gold prices tend to rise as geopolitical tensions increase. But this relationship is not uniform - there is a point where further risk does not translate into higher prices. Beyond this tipping point, the relationship quickly breaks down. In the event of all-out war, paper gold offers little protection. Financial markets would likely cease to function, trading would be suspended, and the inherent value of paper gold (such as gold ETFs) would likely collapse to zero, or close to it. This is not to dismiss gold as a geopolitical hedge but it does have a theoretical limit.

Broad Commodity Exposure

As we discussed last week, historically, geopolitical shocks and wars have often triggered powerful and prolonged commodity super-cycles. Major conflicts drive surges in defence spending, disrupt global supply chains, and can reshape markets - all of which fuel demand for raw materials while constraining supply.

Rather than bet purely on gold, investors may want to consider broader and more strategic allocation to commodities in their portfolios. As the super-cycle chart from last week shows, an escalation in geopolitical tensions or even a spillover into war, can create significant upwards pressure on a wide range of commodity markets.

Macro Hedge Funds

We’ve spoken before about the strategic role hedge fund strategies can play during turbulent times. The past decade of relative calm made it harder for them to stand out. But in today’s choppier waters, marked by elevated volatility and economic uncertainty, hedge funds have more room to manoeuvre. Market dislocations driven by geopolitical risk can create inefficiencies, especially when panic sets in, and that’s when skilled managers can deliver alpha. In particular, global macro funds tend to thrive in these environments, navigating shifts in interest rates, currencies, and geopolitical dynamics.

So in a world where geopolitical risks are mounting, it pays to remember that markets, like the Middle East itself, can be a powder keg. Small sparks can trigger large reactions. For investors, the key is to think carefully about how to hedge that risk. Gold can play a role, but it has limits. Broader commodity exposure and nimble strategies like global macro funds can offer more flexible protection as volatility rises. In this environment, staying prepared matters more than trying to predict exactly when the next spark will fly.

Disclaimer: The information provided in this blog post is for general informational purposes only and should not be construed as financial, investment, or professional advice. The content is not intended as a solicitation, recommendation, endorsement, or offer to buy or sell any securities or financial instruments. Any reliance you place on such information is strictly at your own risk. Always consult with a qualified financial advisor or professional before making any investment decisions. The author and the website assume no responsibility for any losses or damages that may result from the use of or reliance upon the information provided in this blog post.