Are You Late to the Commodity Party?

And which metals could be set to outperform if this rally has room to run

Commodity super-cycles are like parties that take a while to warm up but once they do, they can go on for years. And the signs suggest the next party may be getting started. So you’re not too late. In fact, you might be arriving just as the music picks up.

A rare combination of forces is driving renewed interest in commodities - rising global defence spending, a surge in green energy investment, and a push for economic self-sufficiency as countries rethink supply chains. Together, they’re lifting demand for everything from copper and lithium to steel and oil, while supply struggles to keep pace.

If the last major low around 2020 marks the start of a new cycle, as history suggests, we could still be in the early hours of a long, loud rally. The kegs are just being tapped and the dance floor’s still half empty.

How long can the party go on-for?

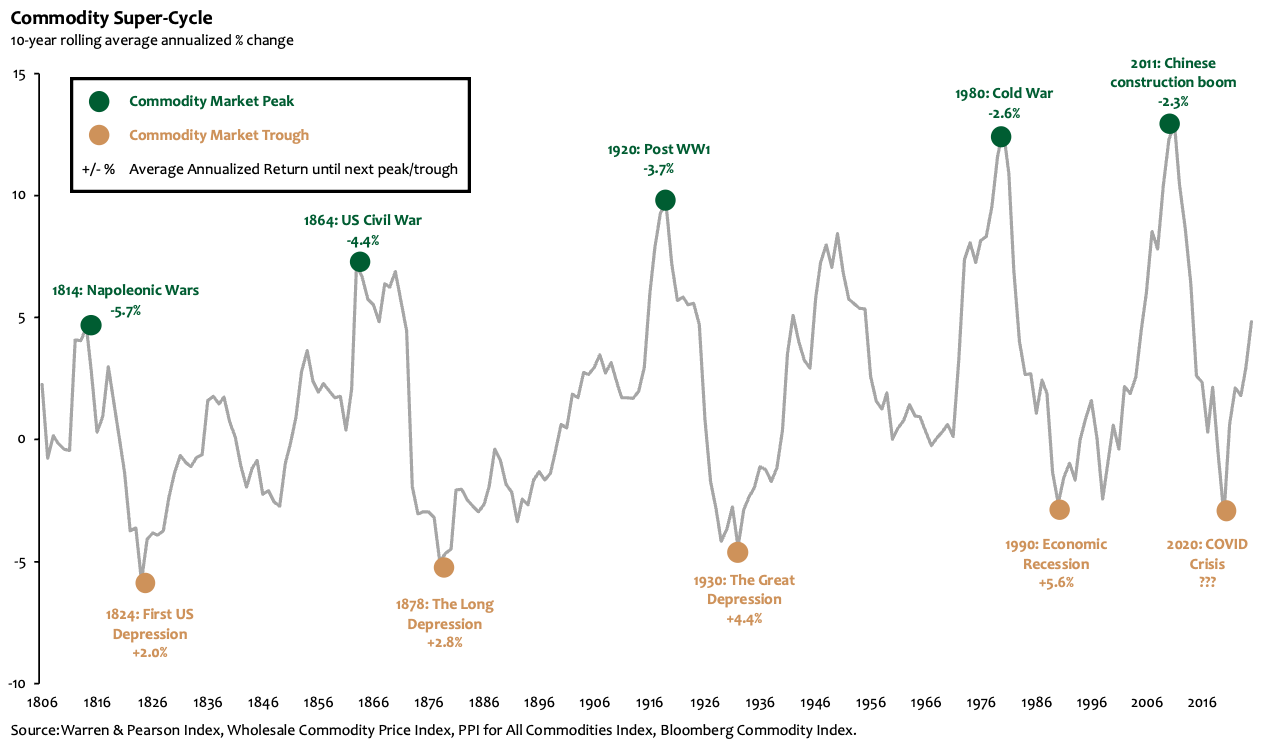

Commodity super-cycles can go on for years. The chart below traces over two centuries of boom and bust cycles, showing how prolonged bull markets can deliver annualised returns of +3.7%. But like any good party, there’s always the risk of a hangover - those drawn-out comedowns between peaks have also averaged annualised losses of 3.7%.

Still, it’s the timing that counts. And if history is any guide, the latest low in 2020, during the COVID-19 shock, might mark the start of a new up-cycle. The last commodity party lasted 20-years - if this cycle were similar it would suggest we have another 15-years of commodity prices rises and, at a historic rate of 3.7% per year, this implies a cumulative upswing of 75% for this party. That would mean we could be in the early hours of a fresh commodity party, with plenty of potential upside ahead.

Why Do These Parties Last So Long?

Commodity markets are driven by structural shifts that take time to play out. Demand is highly elastic and can spike rapidly on the back of a new tech innovation or an energy transition. But the supply side is highly inelastic. Mines don’t open overnight and cost huge sums of money. Rig construction can drag on and permits take years to obtain (see the chart below for average construction time for commodity-specific infrastructure).

Even when major deposits are discovered, the timeline from idea to production can span decades. The Oyu Tolgoi mine in Mongolia was discovered in the early 2000s, but production didn’t start until 2013 and won’t be fully online until 2028. In the U.S., major copper projects like Rio Tinto’s Arizona site have been in limbo for nearly 30 years, held up by permits and public consultations. That slow-build supply response means prices can stay elevated for extended periods, especially if demand keeps hitting the dance floor.

What minerals are late to the party?

While some commodities have already hit the dance floor, others are still finding their way in.

Here are a few that might be arriving fashionably late:

🟠 King Copper

The global shift toward renewable energy and electrification is driving strong demand for copper, essential to electric vehicles, solar panels, and wind turbines. Military rearmament is adding further pressure on copper-intensive infrastructure. Yet supply remains tight. As the chart above shows, copper mines are among the slowest to develop, often taking over a decade to come online. Prices are already elevated, but with such limited new capacity in the pipeline, there may still be more room to run.

🔵 Cobalt

Cobalt is critical to the green transition, used in batteries for electric vehicles and renewable energy storage. Prices, however, have been subdued. That may change. The Democratic Republic of the Congo, responsible for over 70% of global production, imposed a four-month export ban in early 2025 and is now considering more aggressive supply quotas. If the main producer starts tightening the taps, a price recovery could follow quickly.

⚪ Shiny Silver

Gold has stolen the spotlight in the early stages of this supercycle, but silver has lagged behind. As the chart below shows, the gold-to-silver ratio is near its highest level since 1982. With investors looking to diversify their exposure to precious metals, and silver playing a growing role in industrial applications, it may not stay in the shadows for long.

So, in short, the commodity party isn’t over yet, in fact it may be just getting going with commodities such as cobalt, silver and copper all potentially well positioned to do well in the years ahead.

By the way, if you want to learn more about how commodities perform in a portfolio, check out this post from a couple of years ago.

Disclaimer: The information provided in this blog post is for general informational purposes only and should not be construed as financial, investment, or professional advice. The content is not intended as a solicitation, recommendation, endorsement, or offer to buy or sell any securities or financial instruments. Any reliance you place on such information is strictly at your own risk. Always consult with a qualified financial advisor or professional before making any investment decisions. The author and the website assume no responsibility for any losses or damages that may result from the use of or reliance upon the information provided in this blog post.