Value Investing: A Dream of Spring

What do Game of Thrones fans and value investors have in common?

As any long-suffering Game of Thrones fan will tell you, patience is a double-edged sword—equal parts hope and torment. We’ve been waiting 13 years, 4 months, and 5 days (but who’s counting?) since George R.R. Martin last released a book in the A Song of Ice and Fire series, and the long-promised A Dream of Spring seems further away with each passing year. For fans, it’s a test of loyalty and faith, holding out for an ending that might finally deliver. But as the years drag on, doubts creep in, and even the most steadfast wonder if that spring will ever come.

Value investors might relate. Like Game of Thrones fans, they, too, have endured an agonizing wait, hoping to see the fabled return of value over growth. For years, they've clung to the promise that, eventually, market forces will shift, and value will come roaring back. And like Thrones fans holding out for Martin’s finale, value investors continue to sit, watch, and wait—sometimes questioning, but always hopeful.

Just as A Dream of Spring holds the hope of promise and resolution, value investors are hooked on the same possibility of eventual outperformance versus growth. But with both, the real question remains: how long are we willing to wait?

The Long Night & a False Dawn

Value investing has spent years in the shadows, eclipsed by the impressive gains of growth stocks. The chart below shows the long-term relative performance of the Russell 1000 Value versus the Russell 1000 Growth index, stretching back to 1984. Before the Global Financial Crisis (GFC), value and growth took turns in the spotlight, with relatively balanced outperformance. But since early 2009, on a rolling five-year basis, growth has consistently outpaced value.

Following the GFC, a low-interest-rate environment became the popular explanation for value’s underperformance, with lower bond yields favoring growth. Historically, as the next chart shows, higher yields have often aligned with stronger returns for value compared to growth. And while value did make a brief comeback in 2022 as yields rose, this proved a “false dawn.” Growth surged back in 2023 and into 2024, with U.S. growth stocks gaining 23% year-to-date, compared to just 13% from the Russell 1000 Value. The persistence of growth’s edge despite higher yields suggests that value’s struggle runs deeper than just interest rates.

Winds of Winter

One of the main reasons value investing has struggled since the 2008 crisis lies in its heavy reliance on the banking sector. Currently, over 20% of the Russell 1000 Value Index is allocated to financials, making it the largest sector in the benchmark. For value to truly rise from its long night, banking stocks need to perform strongly.

Yet, after the 2008 crisis, policymakers surrounded major banks with regulatory walls to prevent another financial disaster. While these rules have been effective in stabilizing banks (see my previous post on SVB and Credit Suisse), they’ve also curbed banks' ability to generate high profits by taking big risks. The heavy regulations have effectively tempered returns, holding back a key engine of value’s growth potential.

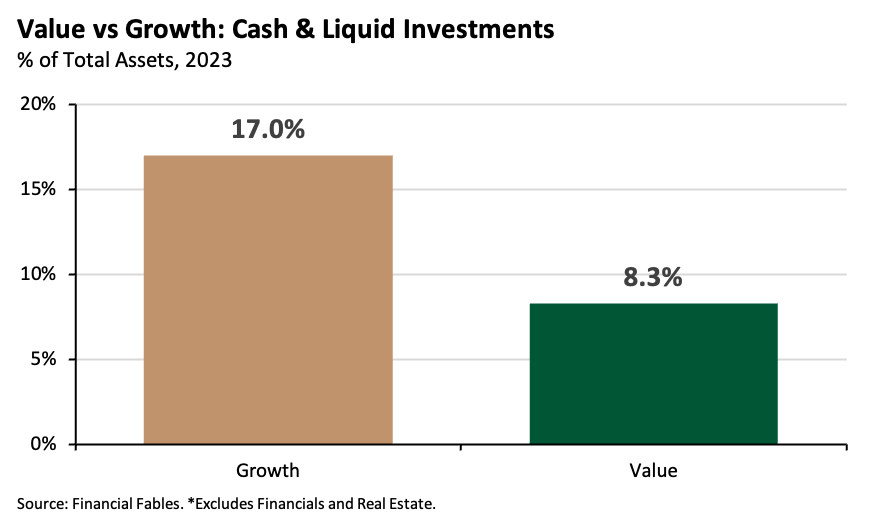

But the burden isn’t only on banks. Beyond financials, value indices lean heavily on older industries like utilities and industrials—20th-century giants that are anchored by aging infrastructures suited to an industrial era. In today's economy, investors prize companies with asset-light models, substantial cash reserves, and a focus on innovation, traits more common in growth stocks than in value. Thus, while value stocks remain trapped by legacy industries, the market’s rewards increasingly go to asset-light, knowledge-driven firms in the growth sector.

A Song of Value & Growth

For both investors and Game of Thrones fans, the hard truth may be learning to accept an unsatisfying conclusion. As a Game of Thrones fan, I am unlikely to ever see the end of the Song of Ice and Fire series. For investors, the persistent underperformance of value stocks versus growth suggests it’s time to reconsider the traditional 50-50 balance between the two in portfolio construction. The fact that value hasn’t rebounded, even as bond yields have risen, should be a wake-up call: value’s challenges go beyond low interest rates. The benchmarks for value are weighed down by structural issues—namely, the low profitability of banking stocks and the stagnation of industrial and utility giants. These legacy firms are struggling to compete with their more agile, asset-light growth counterparts, who appear far better positioned to dominate 21st-century markets. Just as Game of Thrones fans may never get the ending they long for, value investors may need to adapt to a market reality where growth reigns supreme.

Disclaimer: The information provided in this blog post is for general informational purposes only and should not be construed as financial, investment, or professional advice. The content is not intended as a solicitation, recommendation, endorsement, or offer to buy or sell any securities or financial instruments. Any reliance you place on such information is strictly at your own risk. Always consult with a qualified financial advisor or professional before making any investment decisions. The author and the website assume no responsibility for any losses or damages that may result from the use of or reliance upon the information provided in this blog post.