The Legend of the Unicorn Hunters

Central bankers are increasing interest rates and killing off loss-making enterprises. As the number of 'unicorpses' grows investors need to respond.

Unicorns, or more accurately their horns, were thought to contain mythical healing powers that commanded a high price in Medieval Europe. Up until as late as the 1700s, wealthy individuals would pay handsomely for “unicorn horns”. Unfortunately, these “horns” were nothing more than the teeth of narwhals, which were hunted extensively by the Nordic population of Northern Europe to sell to gullible Europeans. But today Vikings have been replaced by a new unicorn hunter: central bankers.

The return of inflation has quickly bought to an end the era negative interest rate policy and large-scale asset purchase programs. Central banks are now tightening at an unprecedented rate and are effectively draining cheap capital away from the market. The issue is that loose monetary policy was the magical pixy dust that was keeping many of the unicorn companies alive. In tightening monetary policy, the central bankers have inadvertently become unicorn hunters and there is now a good chance the herd is about to be thinned.

The lifeblood of low interest rates

Unicorns are not as rare as they used to be. The number of unicorns – startups valued at $1 billion or more – has experienced significant growth over the last decade. In 2013, approximately 35 startups qualified for this magical title. By March 2023, that number had surged to 704. Loose monetary policy has been the magic that has given life to many of these unicorns. Yield-starved investors were eager to add growth to their portfolios and have therefore spent much of the last decade willingly overlooking a significant weakness among startups: their distinct lack of profits. The data is patchy, but anywhere between 60-80% of these unicorns are considered to be unprofitable.

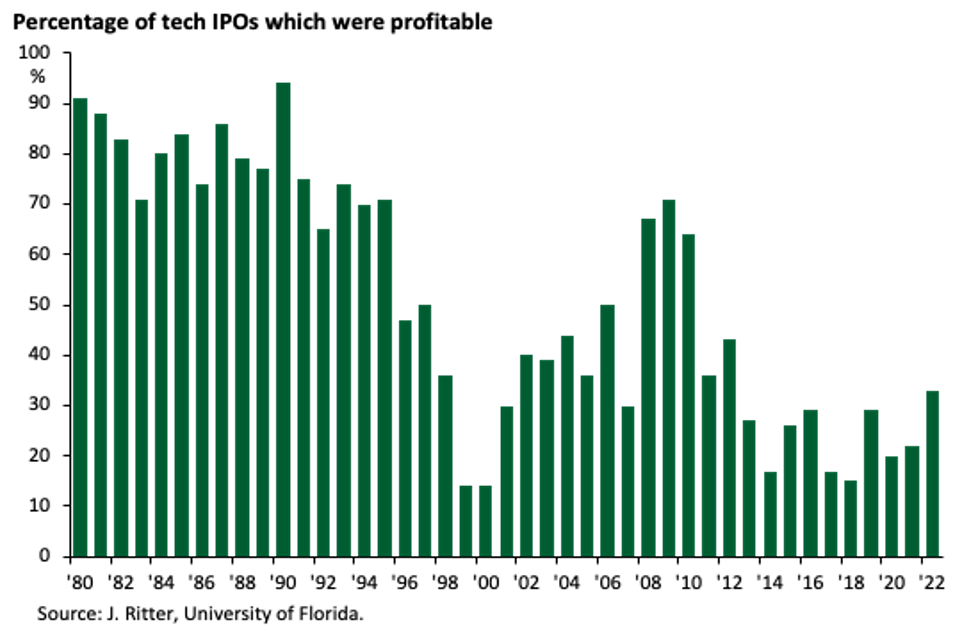

This lack of profitability is also highlighted in the percentage of tech initial public offerings (IPOs) that were profitable when the company first floated its shares. Back in the 80s and early 90s, on average, 78% of tech IPOs were already profitable. That number plummeted to just 14% during the height of the Dot-com bubble. However, in 2022, only 33% of newly floated tech firms could demonstrate persistent profits. Low interest rates have meant that cheap capital has flowed into these firms as desperate investors were willing to overlook this lack of economic viability if it meant injecting some high returns into their slumping portfolios.

What is troubling is the nonchalant attitude towards profits within the tech industry itself. To provide some insight into how unicorns operate, here is a snippet from a conversation I had with a senior technologist at one of Europe’s largest unicorns:

Over the past several years, the focus has been on growth at any cost. We operated under the assumption that every market was a winner takes all market – particularly for consumer digital products. Fast cash resulted in high marketing budgets where vanity metrics such as number of new users were at the forefront of every tech company’s mind.

In theory, growth and profitability should go hand-in-hand; however, in the topsy-turvy world created by negative interest rates, these two variables were no longer tightly linked. Instead, the demand for returns from the financial community gave rise to a single-minded focus on hypergrowth rather than profits. Many start-ups called for blitz-like spending to achieve scale using an Amazon-like model (often referred to in the industry as 'blitz-scaling’). This also manifested in peculiar forms, such as tech firms openly celebrating successful debt raises rather than considering it a cause for concern. As long as the cost of capital remained inexpensive, the magical pixie dust would continue to fall, allowing these loss-making unicorns to remain viable.

Publicly listed markets have suffered too

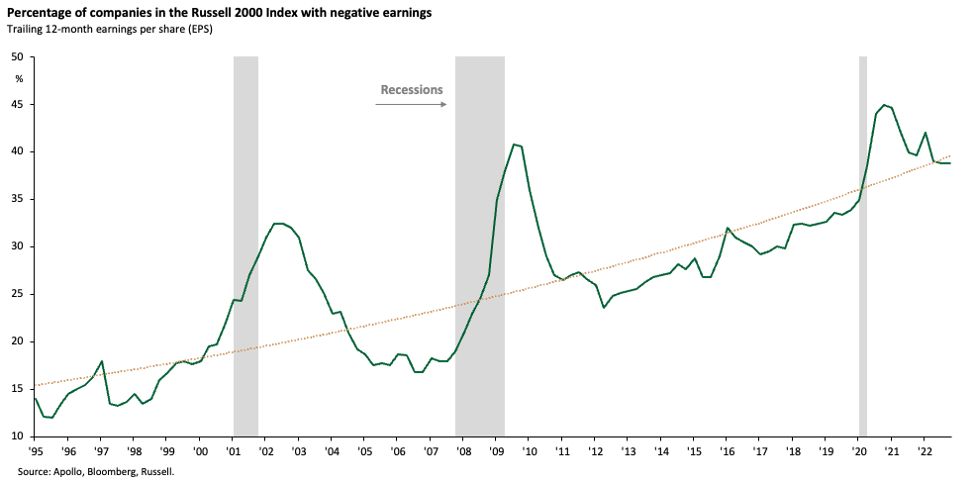

It is easy to pour scorn on boogie, loss-making tech start-ups; however, the 'magic' of negative interest rates has also permeated publicly listed markets. Torsten Sløk, Chief Economist at Apollo, has conducted some interesting research tracking the prevalence of the negative earnings issue across equity markets. In the 1990s, only about 15% of companies in the Russell 2000 index had negative earnings growth. In 2023, that number has now risen to 40%, with the trend on track to reach 50% by the end of the decade.

Here come the hunters

However, higher interest rates serve as the horn, signaling the start of the hunt for these struggling, loss-making corporations. Tighter monetary policy has prompted a shift in priorities. The objective is no longer solely growth, but profits. Business ventures must now be economically viable or at least offer a practical pathway to profitability in order to evade the hunters. Yet, this shift of focus from growth to profits has brought about pain within the tech community. Reflecting on my conversation with a senior technologist:

2022 was a shock to the system. When the cash dried up, there was a rapid pivot to profitability which companies were not setup to respond to. This resulted in the rapid succession of layoffs at companies from the FAANGs through to scale-ups and startups.

Indeed, the tech community appears to be undergoing its own sectoral recession. Nearly 250,000 US-based tech workers have been laid off in the last 18 months as higher interest rates compel painful adjustments across the industry. While workers are grappling with challenges, there have already been some high-profile casualties thrown onto the pile of ‘unicorpses’. FTX, a now defunct cryptocurrency exchange, stands out as a notable example. Despite its initial profitability, Klarna, a Swedish online financial services firm, has been forced to reduce its valuations by an astonishing 85% after four consecutive years of substantial losses. Silicon Valley Bank, which collapsed in March 2023, was the preferred bank for the owners of many unicorns and aspiring tech startups, providing them with a range of financial services. This hunt is likely to take some time. Unraveling the distorted effects of a decade of loose monetary policy in just a few short months seems implausible.

The sounding of the horn

The sounding of the hunting horn has sent a clear message: present a pathway to profitability or be culled from the herd. Higher interest rates are bringing some much needed discipline to the marketplace but how should investors respond?

If interest rates remain elevated for an extended period, we should brace ourselves for further consolidation within the tech sector and other loss-making industries. Against this backdrop, investors will need to adopt a more discerning eye between potential winners and losers. An investment environment of greater dispersion should lend itself well to a long-short strategy, particularly one focused on markets with a high degree of negative earning companies. Those corporations that can showcase profitability will likely see their share price rise in a relief rally, helping add alpha on the upside. Meanwhile, those too weak to outrun the hunters will see themselves added to the growing pile 'of ‘unicorpses’.

If you enjoyed this piece and want to hear more financial fables please consider subscribing to Financial Fables.

Disclaimer: The information provided in this blog post is for general informational purposes only and should not be construed as financial, investment, or professional advice. The content is not intended as a solicitation, recommendation, endorsement, or offer to buy or sell any securities or financial instruments. Any reliance you place on such information is strictly at your own risk. Always consult with a qualified financial advisor or professional before making any investment decisions. The author and the website assume no responsibility for any losses or damages that may result from the use of or reliance upon the information provided in this blog post.