Jupiter Rising

The U.S dollar has such a strong gravitational pull that it can have huge ramifications for all global investors and their portfolios

Jupiter’s colossal presence has had a pivotal role in the shaping of our solar system. This cosmic giant has a gravitational pull that is 2.5 times greater than that of Earth, which explains its massive celestial entourage of at least 79 moons that orbit this gas titan. Its size allows it to influence comets and asteroids light-years away, pushing or pulling them as it sees fit.

In my mind, Jupiter’s gravitational influence is not dissimilar to that of the US dollar. The dollar's privileged status as the world’s reserve currency means that it has an immense influence spanning the entire global financial system. Even small changes in its direction can exert a significant effect on many asset classes around the world, sometimes with devastating effects. It's essential for investors to predict its movements and adjust to its fluctuations in order to properly manage (and protect) their portfolios.

What influences the dollars orbit?

The dollar's orbit might not be as predictable as Jupiter, but its movements are not random either. Economic theory suggests that it is the flow of goods and services that influence a country’s currency. Theoretically, if a country with a free-floating currency begins exporting significantly more than it's importing, the improvement in its net trade position (also known as the current account) should see its domestic currency begin to appreciate.

This seemingly simple observation is the by-product of decades of economic debate spanning multiple schools of economic thought. Keynes argued about the importance of the current account in stabilizing the exchange rate. Milton Friedman, a leading figure from the Chicago School of Economics, linked the need for flexible exchange rates as a requirement for managing fluctuations in the current account balance. Robert Mundell, widely considered to be the ‘father of the euro,’ also dedicated a significant amount of time to discussing the importance of the terms of trade. The fixation on the current account by such a wide array of scholars is why the current account features so prominently in many economics textbooks; however, its importance in real-world financial markets is grossly overstated.

Much of the traditional theory came before the advent of modern, globalized financial markets. Today, the capital account dwarfs the current account by some margin. In 1970, both the current and long-term capital accounts were in deficit by $3 billion. Fast forward to 2023, the U.S. current account deficit was reported to be approximately $200 billion in size. Meanwhile, the U.S. net international investment position (a related concept to the capital account) stood at -$18.2 trillion. In short, the growth in financial markets and cross-border investment activity has meant that the dollar has become increasingly sensitive to financial market variables and less reliant on the movement of goods and services.

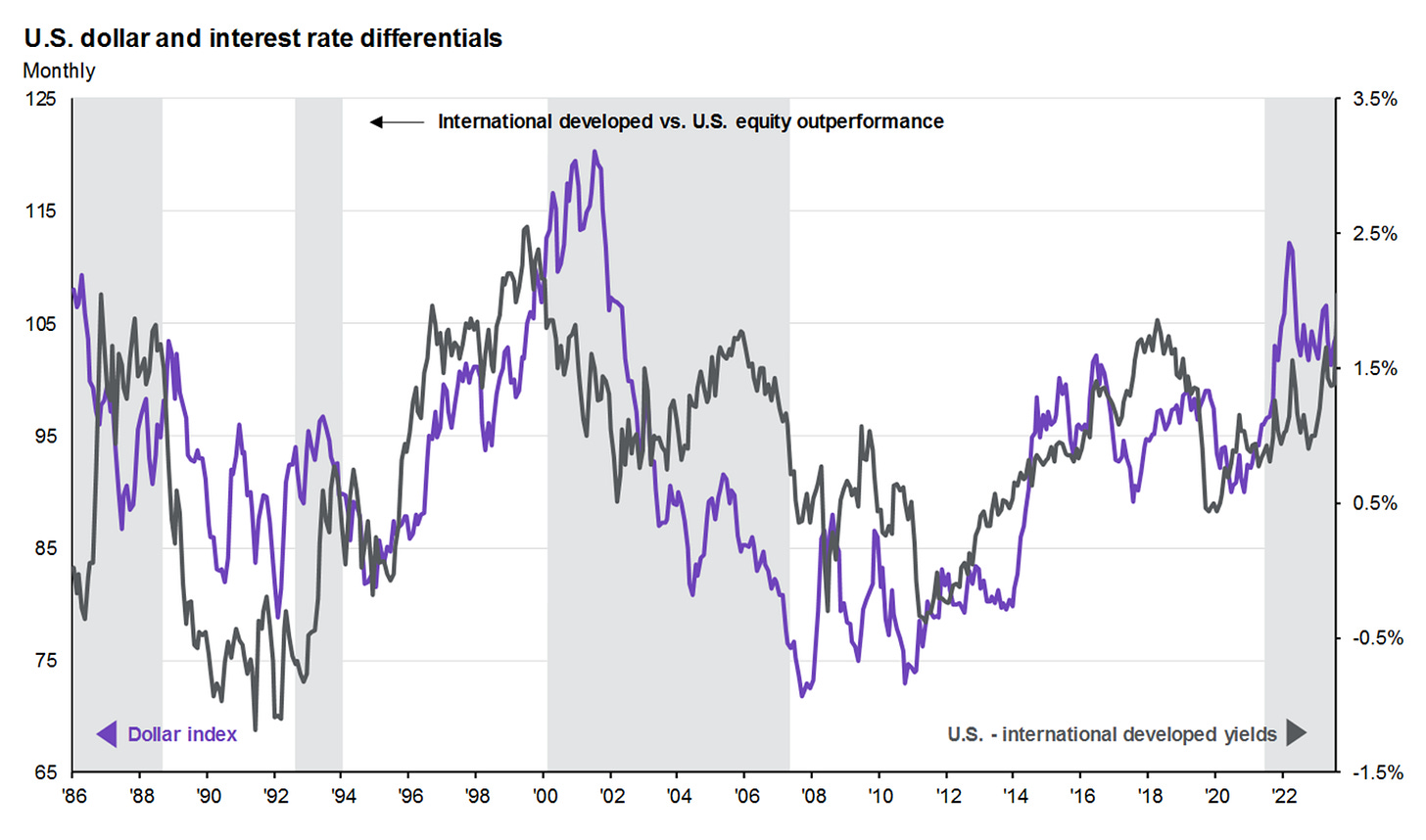

The sheer magnitude of the capital account means that the movements in financial markets have a much more profound impact on the value of the dollar than changes in the amount of goods and services moving back and forth. Interest rate differentials, i.e., the difference between interest rates in one country versus another, have a much larger influence on the value of the dollar. If interest rates overseas begin rising versus the yields in the U.S., capital will begin to flow out of the U.S., weakening the dollar. Meanwhile, a meaningful increase in U.S. rates will attract capital from overseas, bolstering the value of the dollar. The chart below ('borrowed' from my U.S friends at J.P. Morgan Market Insights) highlights how closely linked interest rate differentials have become with the value of the U.S. dollar.

US exceptionalism & the dollar

So, what is the immediate trajectory for the dollar? Following the sharp take-off in interest rates led by the U.S. Federal Reserve, the dollar appreciated throughout much of 2022. As foreign central banks began to hike rates and interest rate differentials began to stabilize, the dollar began moving sideways through much of 2023. With the Federal Reserve poised to cut rates this year, it has led to a number of calls to prepare for dollar weakness, but is that right?

I attended a conference a couple of weeks ago that included a number of experienced investors. While there was a wide range of views exchanged, one common prediction was that we are entering into a period of "US exceptionalism." While a very catchy term, it was hard for people to define exactly what variables actually justified it. Here are just a few potential justifications that were provided to me:

The rise of A.I: Some investors suggested that the U.S. economic system was inherently more flexible than the rest of the world and would better be able to capture the benefits of artificial intelligence. Broadly, the country’s technological prowess is certainly ahead of many of its peers.

Legal & Bankruptcy procedures: The strength of the country's legal and bankruptcy procedures allows America to more effectively recycle capital than other economies, particularly China, where there is a huge debt build-up.

Demographic Profile: While it is aging, the U.S. demographic profile is significantly younger than Europe and a number of emerging markets, including China.

To me, all of the above reasons are somewhat valid, but they have long been factors influencing the US growth dynamic. They are not particularly unique to the post-COVID age. Instead, what I think frames US exceptionalism is the strength and productivity of its labor market relative to the rest of the world.

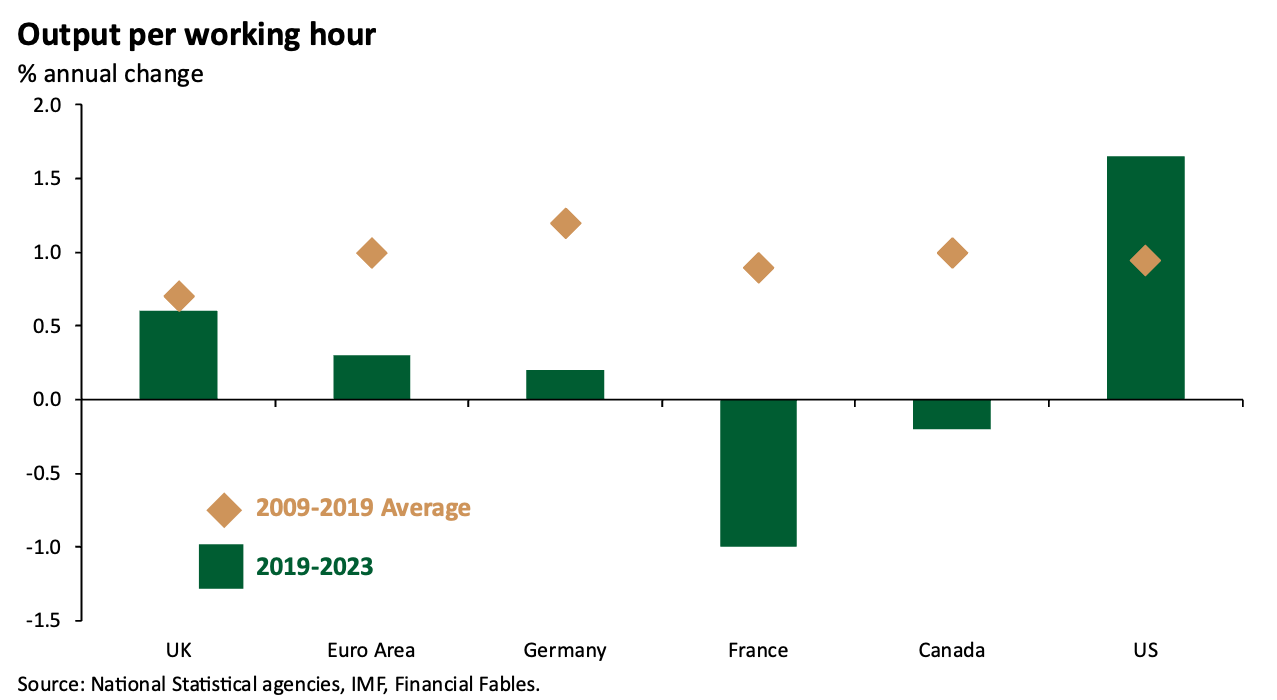

In the post-COVID age, productivity and labor dynamics have changed dramatically. After two years of remote working, the global labor force has dramatically reassessed their work-life balances and opted for a more flexible approach towards work. While there are plenty of merits to a more balanced approach to work, it does typically come at the expense of worker productivity and output. If workers are no longer dedicating every possible hour to their job, then output is likely to suffer. As the below chart shows, in many of the world's major economies, productivity growth since the pandemic has been meaningfully lower than in the decade prior, with one notable exception: the USA.

The U.S. is unique. Not only are its productivity levels post-COVID higher than those of its peers, but the annual improvement is even higher than it was between 2009-2019! A more productive workforce is likely going to drive significant outperformance of US growth versus the rest of the world. Higher growth, improved earnings, and a more resilient economic backdrop all suggest that we are embarking on an age of U.S. exceptionalism, likely driving a prolonged increase in the value of the US dollar.

While U.S. exceptionalism is likely to take many forms in the years ahead, it will be the quality and output of its workforce that will produce the most tangible results relative to the rest of the world. A more productive workforce leads to faster growth, improved earnings, and a more robust economic backdrop that likely means that a prolonged rise in the U.S. dollar is imminent as this economic behemoth sucks in capital from around the world.

The many moons of Jupiter

Returning to this concept of the dollar being a lot like Jupiter: If it is now set to ascend, then it is going to have a significant gravitational pull on the various asset classes that orbit around it:

Emerging Markets: A strong US dollar is typically bad news for EM economies broadly. A strong dollar often results in tighter financial conditions and a deprivation of capital for many developing economies. It also places significant pressure on their debt burdens, especially for those with dollar-denominated debt. As the dollar rises, these debts become more expensive to service, placing greater strain on tax revenues. Considering the already hazardous debt position that some emerging economies find themselves in (see prior blog post), a rising dollar could push more economies toward financial distress.

European & Japanese markets: A strengthening dollar is a headache for US investors seeking access to European or Japanese markets. As the dollar rises, it nibbles away at foreign returns. One option is to explore currency hedging opportunities as a way of mitigating this rise; however, not all investors have access to these options. Instead, dollar-based investors may just look to stay at home rather than shop abroad.

Internationally exposed U.S. equities: US equities source approximately 30% of their revenues from overseas, with some global multinationals being particularly diverse. Coca-Cola, for example, gets over 70% of its revenues from outside of the US. A rising dollar is a headache for these international firms as it lowers their overseas earnings when converting the funds back into US dollars. One option for investors is to move down the capital structure and look for opportunities in U.S. small and mid-caps that are typically more domestically focused than their larger, global peers.

Commodities: Considering that commodities are denominated and typically settled in US dollars, a rising dollar can impact the supply and demand dynamics of everything from oil to wheat. A rising US dollar typically limits demand as prices begin to rise, which is often bad news for net commodity importers, but there are a handful of countries that benefit. Net commodity exporters such as many Middle Eastern economies, some sub-Saharan economies, and Latin American economies can see their prospects rise as the value of their exports begins to rise. In a rising dollar environment, a selective approach to emerging market equities may work well.

In the vast financial cosmos, a rising US dollar, is likely to shape the various asset classes that are in its orbit. A period of U.S exceptionalism, driven primarily by the large and growing productivity differentials between the US and its rivals, likely means faster growth, higher rates and a strong dollar. Such an approach is likely to have a profound impact on the many asset classes that orbit the US dollar. In emerging markets and international equities, there will be a need for more selectivity as a rising dollar can put significant pressure on these areas however, US equities, particularly small and mid-cap could stand to benefit from an ascending dollar.

Disclaimer: The information provided in this blog post is for general informational purposes only and should not be construed as financial, investment, or professional advice. The content is not intended as a solicitation, recommendation, endorsement, or offer to buy or sell any securities or financial instruments. Any reliance you place on such information is strictly at your own risk. Always consult with a qualified financial advisor or professional before making any investment decisions. The author and the website assume no responsibility for any losses or damages that may result from the use of or reliance upon the information provided in this blog post.